Expense Types

Understanding expense types in Expensify helps you track and categorize business spending more effectively. This guide covers how to organize reports by expense type and explains the differences between reimbursable, non-reimbursable, and billable expenses.

Organize a Report by Expense Type

Organizing reports by expense type helps streamline expense review:

- Open the desired report.

- Click Details in the upper-right corner.

- Click the View dropdown and select Detailed.

- Click the Split by dropdown and select Reimbursable or Billable.

- To group expenses further, use the Group by dropdown to select Category or Tags.

Identify Expense Types

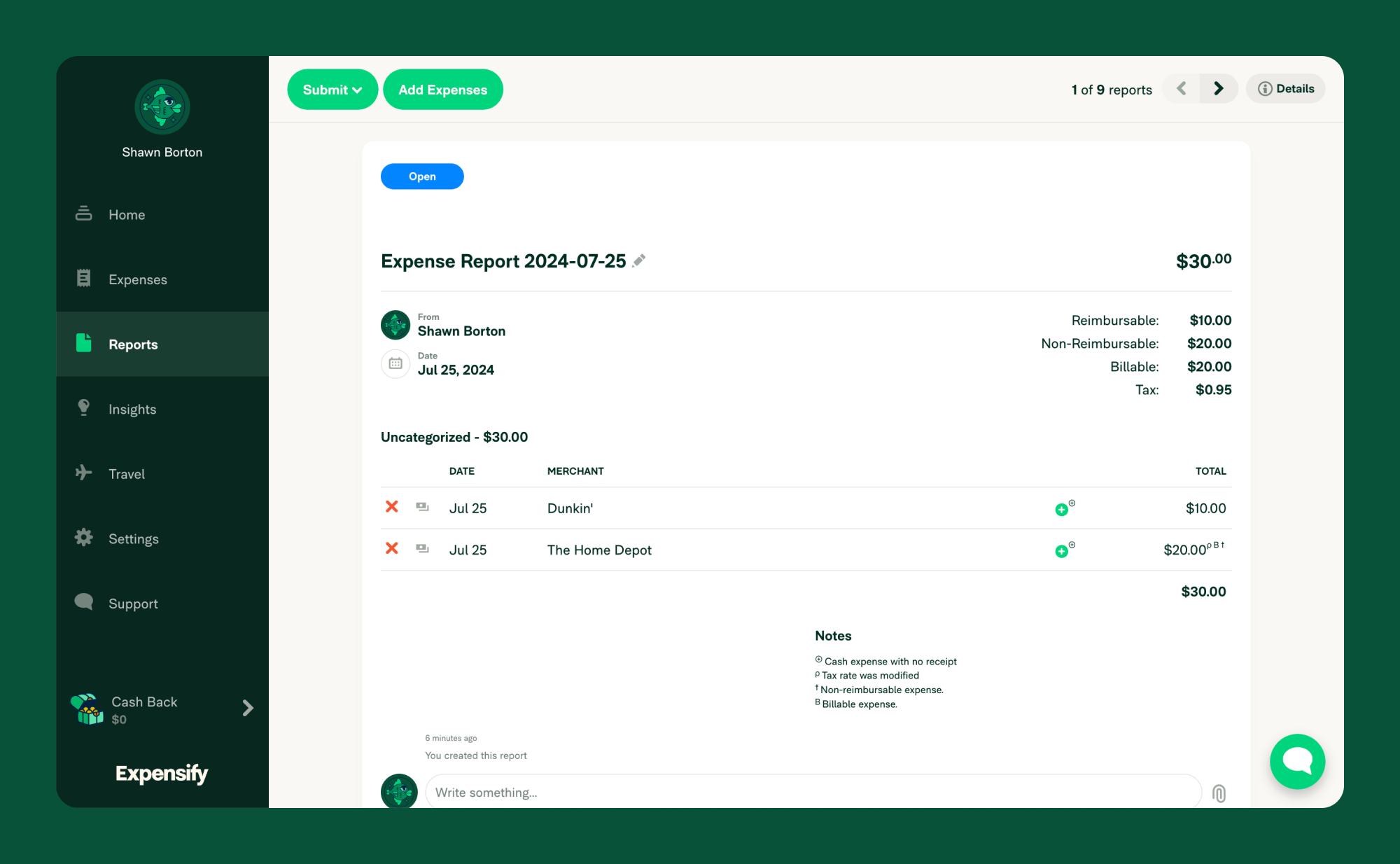

The right side of every report displays total expenses, broken down by reimbursable, billable, and non-reimbursable amounts.

Reimbursable Expenses

Expenses paid by employees on behalf of the business, including:

- Cash & Personal Card: Out-of-pocket business expenses.

- Per Diem: Daily expense allowances configured in your workspace settings.

- Time: Hourly wages for jobs, typically used for contractor invoicing. Configure rates here.

- Distance: Mileage-related expenses.

Non-Reimbursable Expenses

Expenses that are directly covered by the business, usually on company cards.

Billable Expenses

Expenses billed to a client or vendor. Any expense—reimbursable or non-reimbursable—can also be billable.

Deleting Expenses

Expensify does not permanently delete expenses in open accounts to prevent lost funds or reconciliation issues. Instead, expenses are soft deleted, meaning they are moved to a Deleted folder. This ensures that:

- Accidental deletions can be easily reversed.

- No financial data is permanently lost within an active Expensify account.

- Users maintain better control over expense records.

Recovering Deleted Expenses

If you need to restore a deleted expense:

- Navigate to Expenses in your Expensify account.

- Click the Filters icon and select Deleted to view all soft-deleted expenses.

- Locate the expense you want to recover.

- Click Restore to move the expense back to its original state.

Managing Deleted Expenses

- Deleted expenses remain in the system for reference, ensuring no financial data is lost.

- Expenses can be restored at any time unless permanently removed by an admin.

- If an expense is deleted in error, you can restore it using the steps above.

Filtering Expenses

Use filters to narrow down the data:

- Click the Expenses tab.

- Adjust the filters at the top of the page:

- Date Range – Select a specific time frame.

- Merchant Name – Find expenses from a particular vendor (partial searches work).

- Workspace – View expenses for a specific Group or Individual Workspace.

- Categories – Filter by category to refine your search.

- Tags – Locate expenses based on assigned tags.

- Submitters – Find expenses by employee or vendor.

- Personal Expenses – Show expenses that have not yet been added to a report.

- Draft, Outstanding, Approved, Paid, Done – View expenses at different reporting stages.

Note: Some filters adjust dynamically based on your current selections. If results aren’t as expected, click Reset to clear all filters.

FAQ

What’s the difference between an expense, a receipt, and a report attachment?

- Expense: Created when you SmartScan or manually upload a receipt.

- Receipt: Image file automatically attached to an expense via SmartScan.

- Report Attachment: Additional documents (e.g., supporting documents) added via the paperclip icon in report comments.

How are credits or refunds displayed in Expensify?

Credits appear as negative expenses (e.g., -$1.00). They offset the total report amount.

For example:

- A report with $400 and $500 reimbursable expenses shows a total of $900.

- A report with -$400 and $500 expenses results in a $100 total.

Can I permanently delete a cash expense?

Permanently deleting cash expenses is restricted to ensure accurate financial records. It is possible to delete company card expenses, as long as the expenses have not been submitted, by unassigning the employee’s card at the domain level.

How do I find my deleted expenses?

Use the Filters option in the Expenses tab and select Deleted to view all soft-deleted expenses.