Set Up and Manage the Expensify Card

Workspace Admins can enable and issue Expensify Visa® Commercial Cards to manage company spending with real-time controls and flexibility across employees and subscriptions.

The Expensify Card offers powerful spend control tools, including:

- Unlimited virtual cards

- Individual monthly or fixed spend limits

- Custom names for easier categorization

- Spend restrictions by employee and merchant

- Real-time visibility and cash back rewards

Prerequisites: You must be a workspace admin and have a U.S. business bank account connected to Expensify. See this guide on connecting a business bank account.

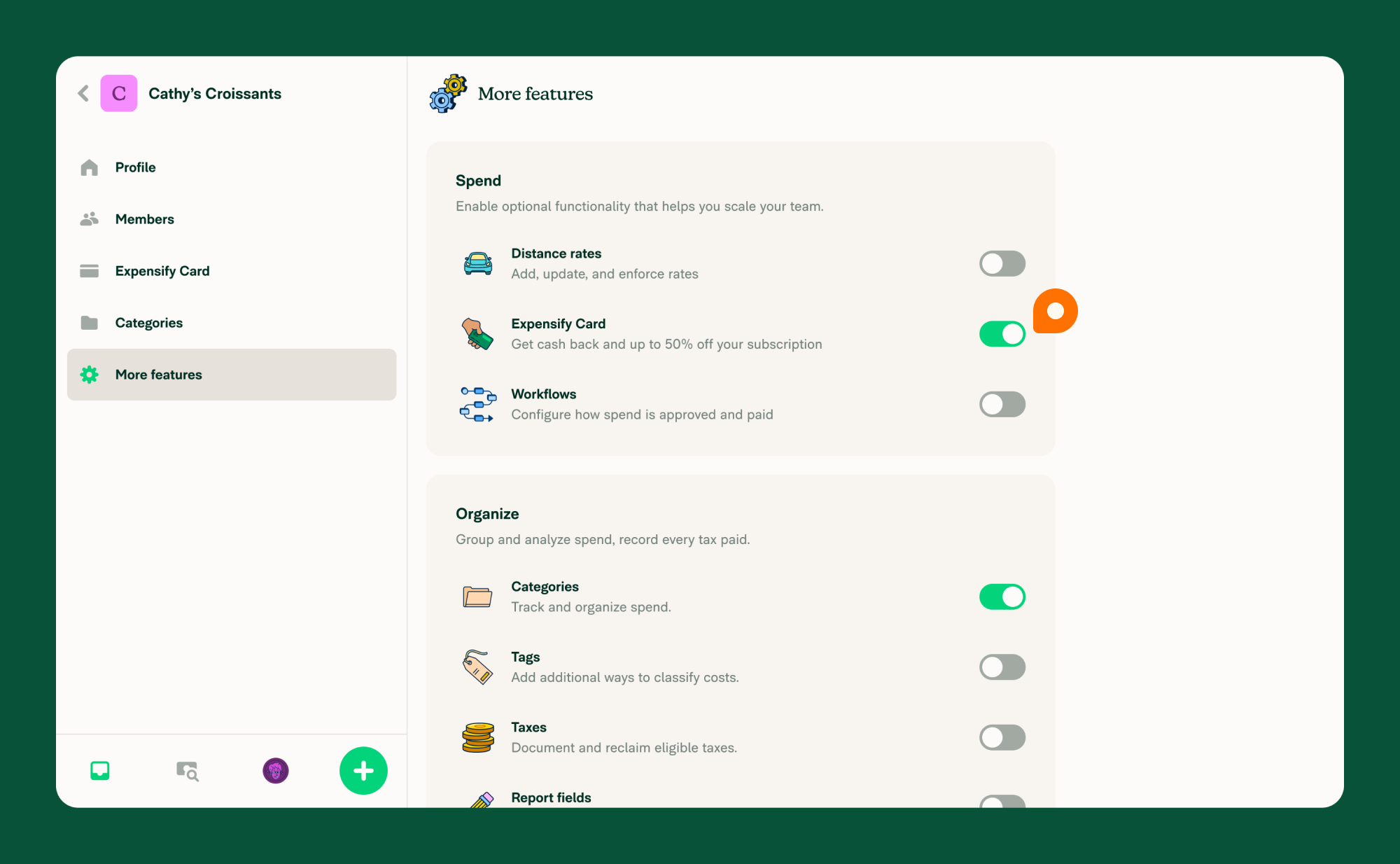

Step 1: Enable the Expensify Card

To turn on Expensify Cards for your workspace:

- From the left-hand menu, select Settings > Workspaces > [Workspace Name] > More features

- Under Spend, toggle on Expensify Card

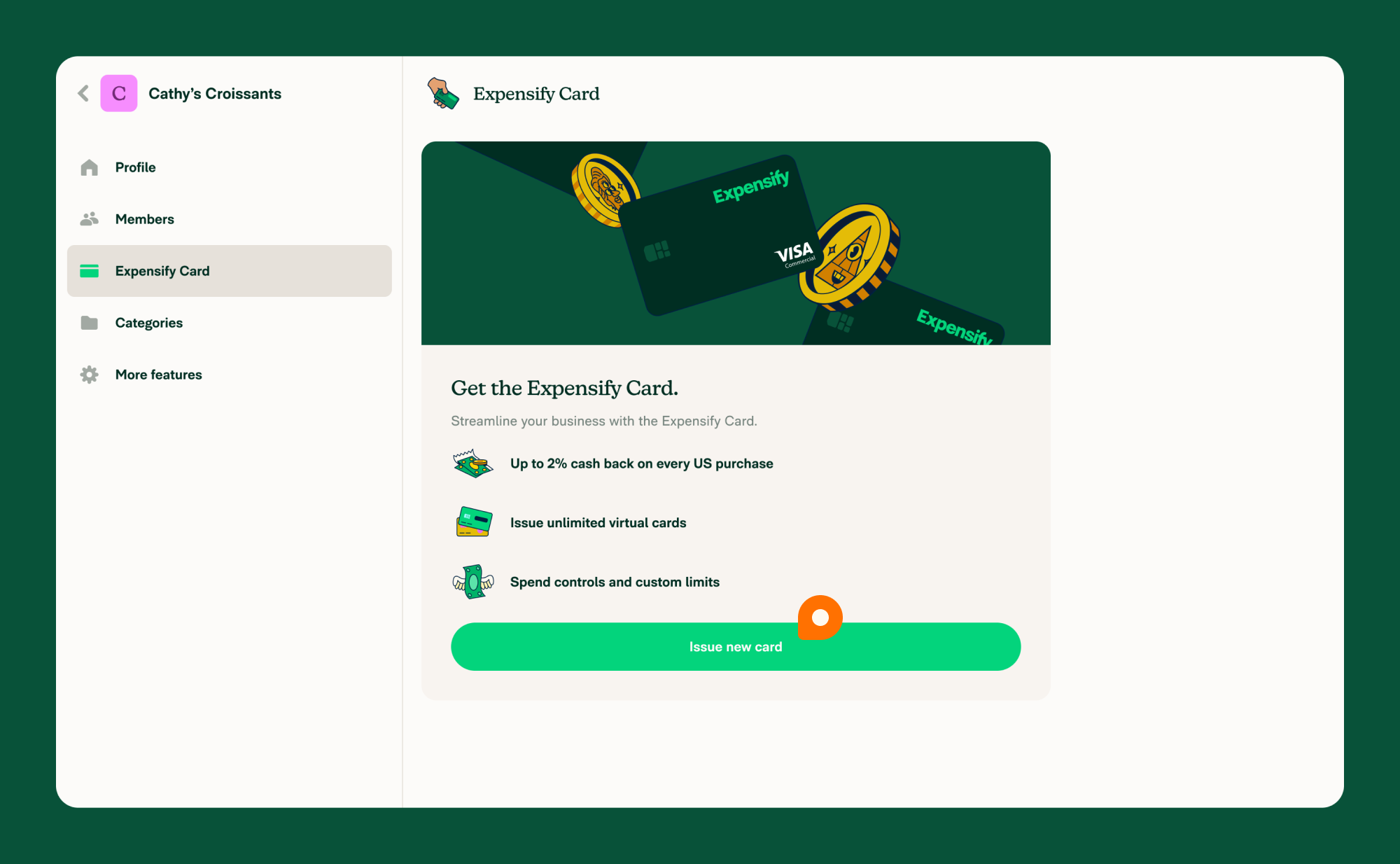

Step 2: Select a Bank Account

Link a U.S. business bank account to pay the card balance:

- From the navigation tabs (on the left on web, and at the bottom on mobile), select Workspaces > [Workspace Name] > Expensify Card

- Click Issue new card

- Choose an existing account or add a new bank account as the settlement account.

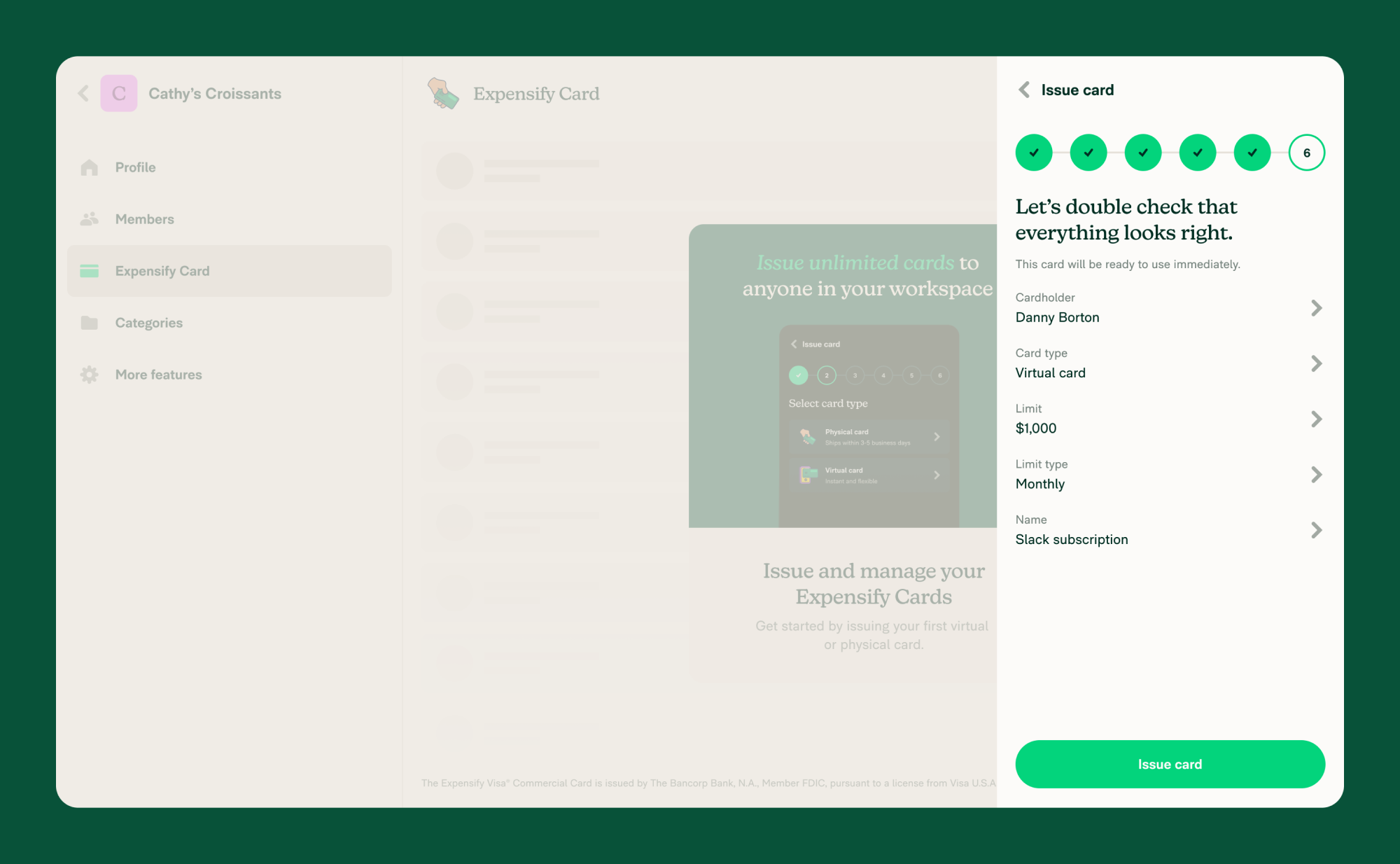

Step 3: Issue Expensify Cards

You can issue virtual or physical cards to employees:

- From the navigation tabs (on the left on web, and at the bottom on mobile), head to Workspaces > [Workspace Name] > Expensify Cards

- Click Issue new card

- Select the employee

- Choose Virtual or Physical

- Pick a limit type:

- Smart limit: Spend up to a threshold before needing approval

- Monthly limit: Capped monthly spend

- Fixed limit: One-time cap, card closes when reached

- Enter the spending limit

- Name the card for easier tracking

- Click Issue card to confirm

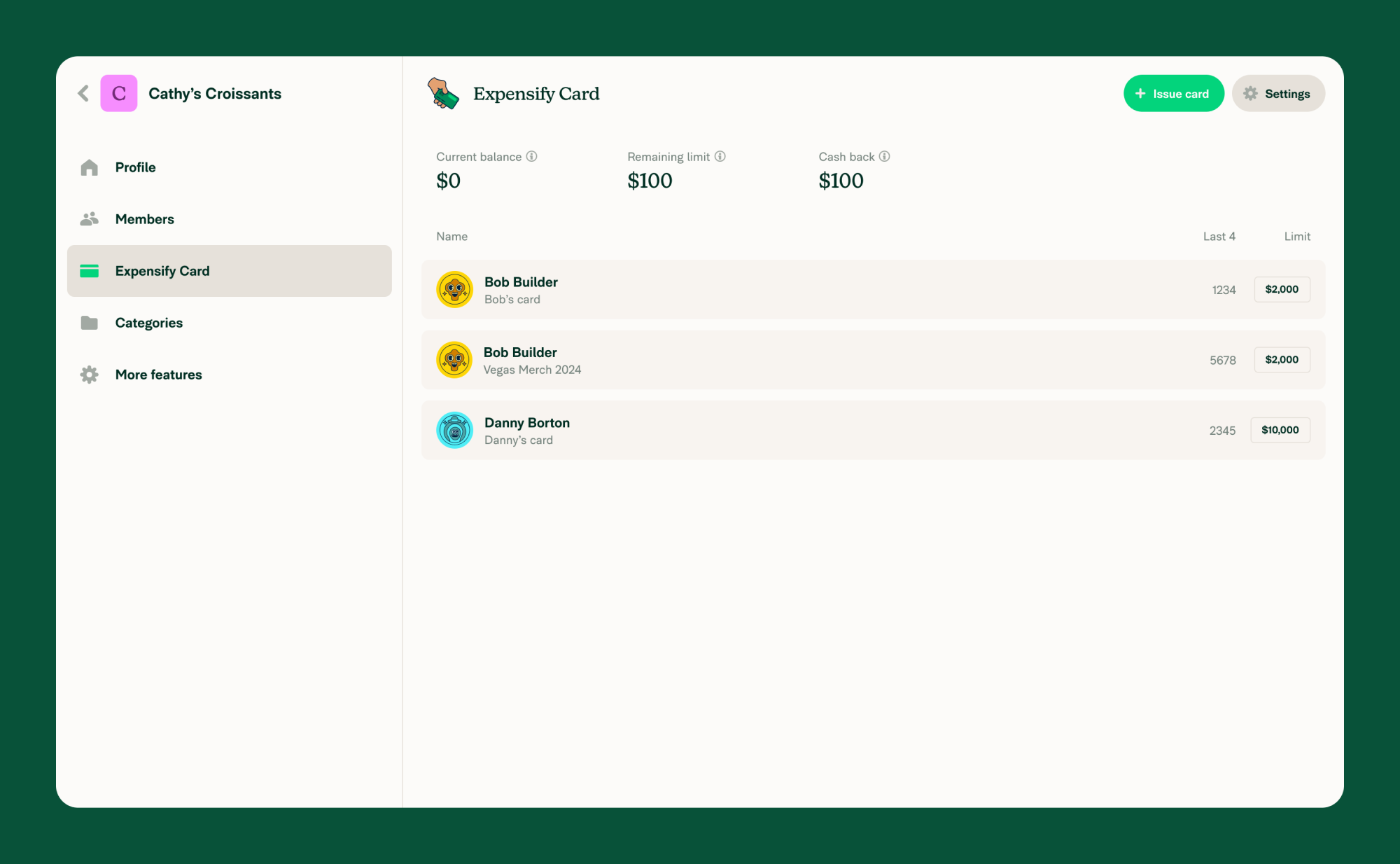

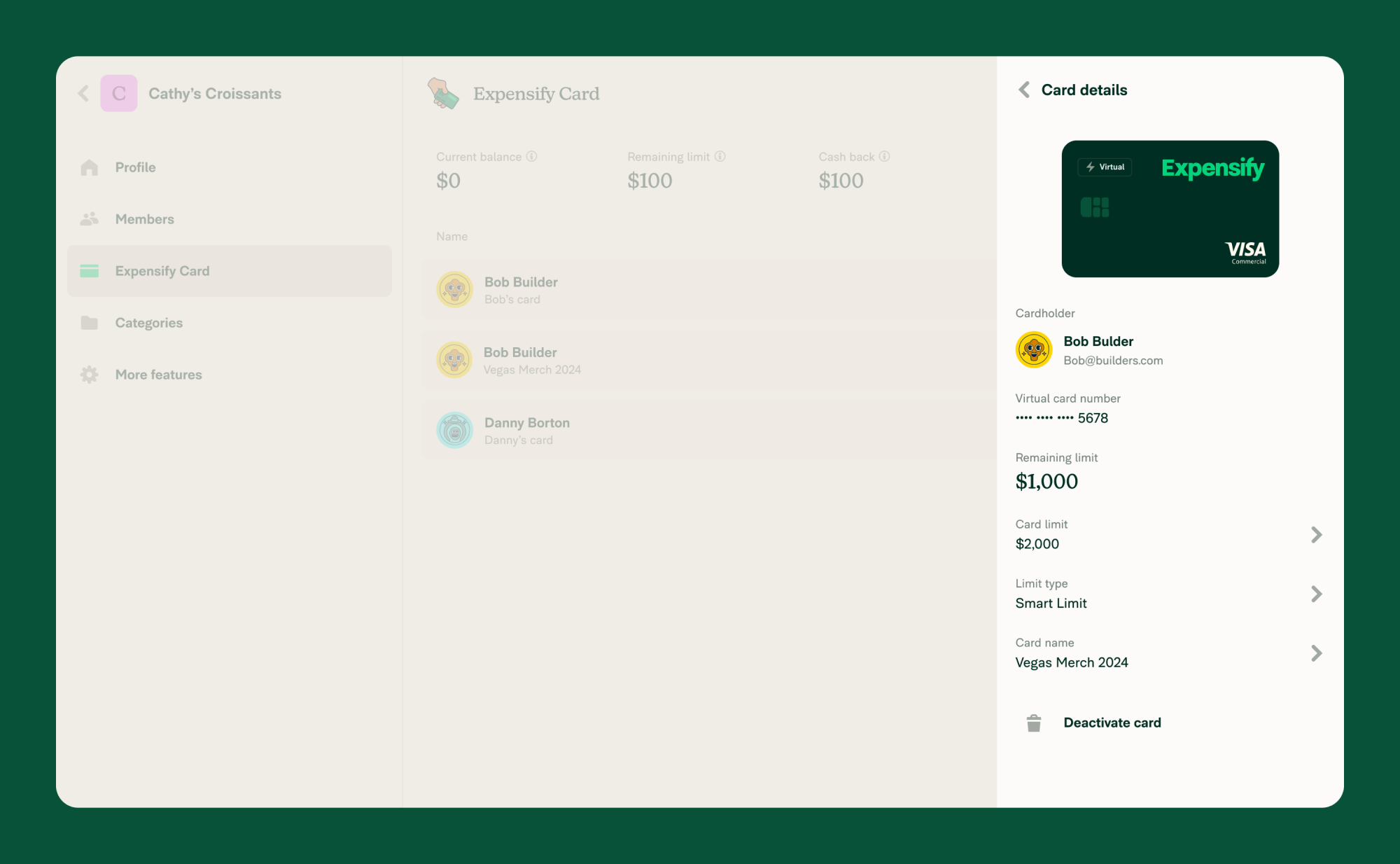

Monitor and Manage Cards

After issuing cards, you can view, adjust, or deactivate them:

- From the navigation tabs (on the left on web, and at the bottom on mobile), select Workspaces > [Workspace Name] > Expensify Card

- See a list of all issued cards

- Click a card to view details or adjust:

- Spending limit

- Limit type

- Card name

- Deactivation

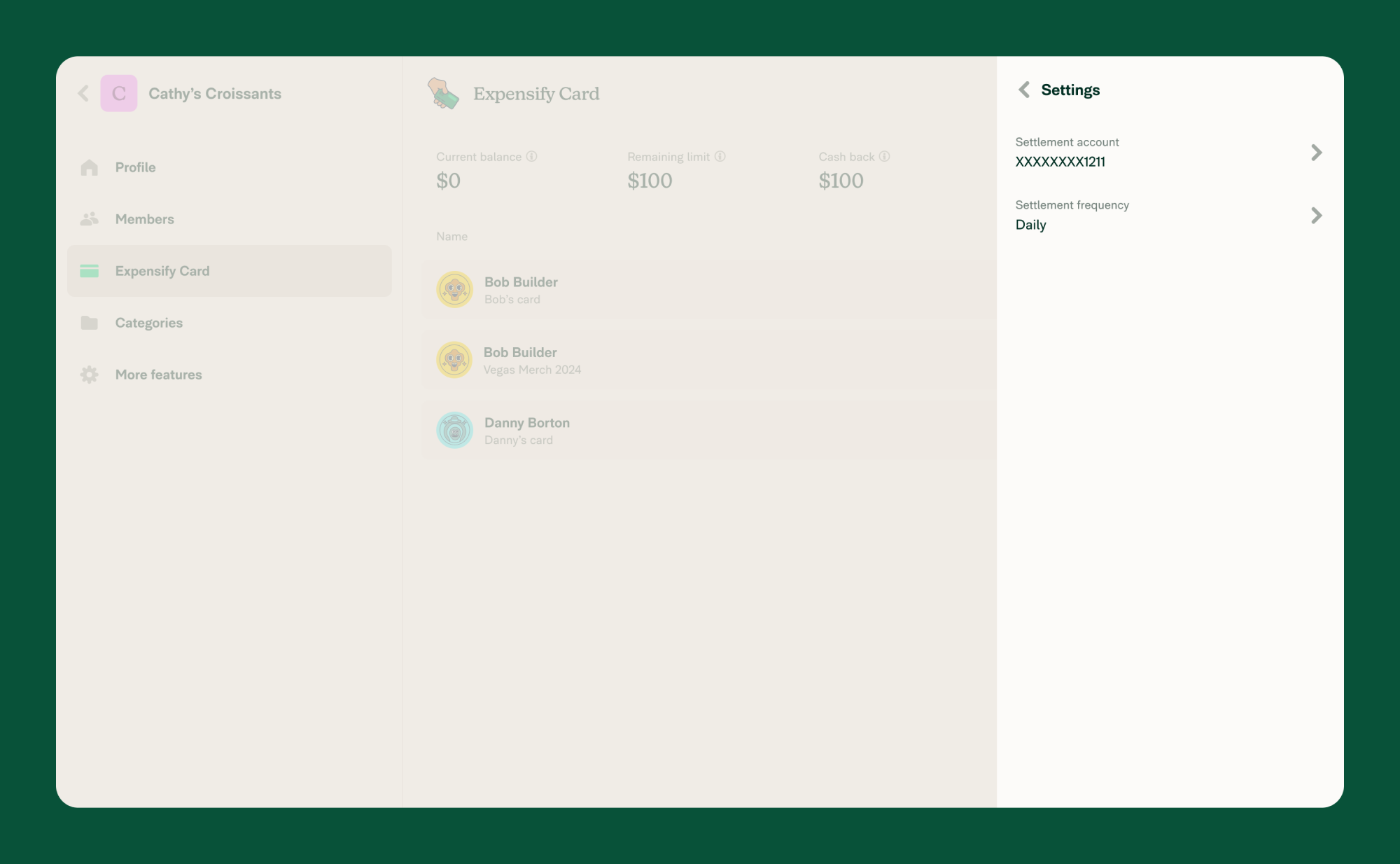

- To change the linked bank account or update settlement frequency, click Settings.

FAQ

What kind of bank account is required?

You’ll need a U.S. business bank account registered to a U.S.-incorporated business.

Can I use Expensify Cards across multiple workspaces?

Yes, but each workspace must have its own settlement account. For example, using the card in three workspaces requires three separate bank accounts.

Can an employee have multiple cards?

- Yes: Employees can have unlimited virtual cards (e.g. for trips or subscriptions).

- Yes: Employees can be issued multiple physical cards with different limit types.

How is the Expensify Card limit determined?

The limit is the maximum combined spending limit for all Expensify Cards in your domain. It’s calculated using:

- Available balance in the verified bank account set as your settlement account

- Pending expenses and unsettled transactions

- Funds availability tracked via Plaid

- Settlement cycle timing, which usually takes three business days

What affects the Expensify Card limit?

- Available funds: A sudden drop in your linked bank account can reduce your Domain Limit.

- Pending expenses: Large, unprocessed purchases temporarily reduce your spending capacity.

- Processing settlements: Until the previous cycle settles, your limit adjusts dynamically.