Connect a Business Bank Account

You can connect a business bank account in New Expensify using the following supported currencies: USD, CAD, GBP, EUR, and AUD.

Follow the steps below to connect your business bank account and enable payment features.

How to connect and verify a business bank account

Step 1: Enable Make or Track Payments

- Click Workspaces in the navigation tabs

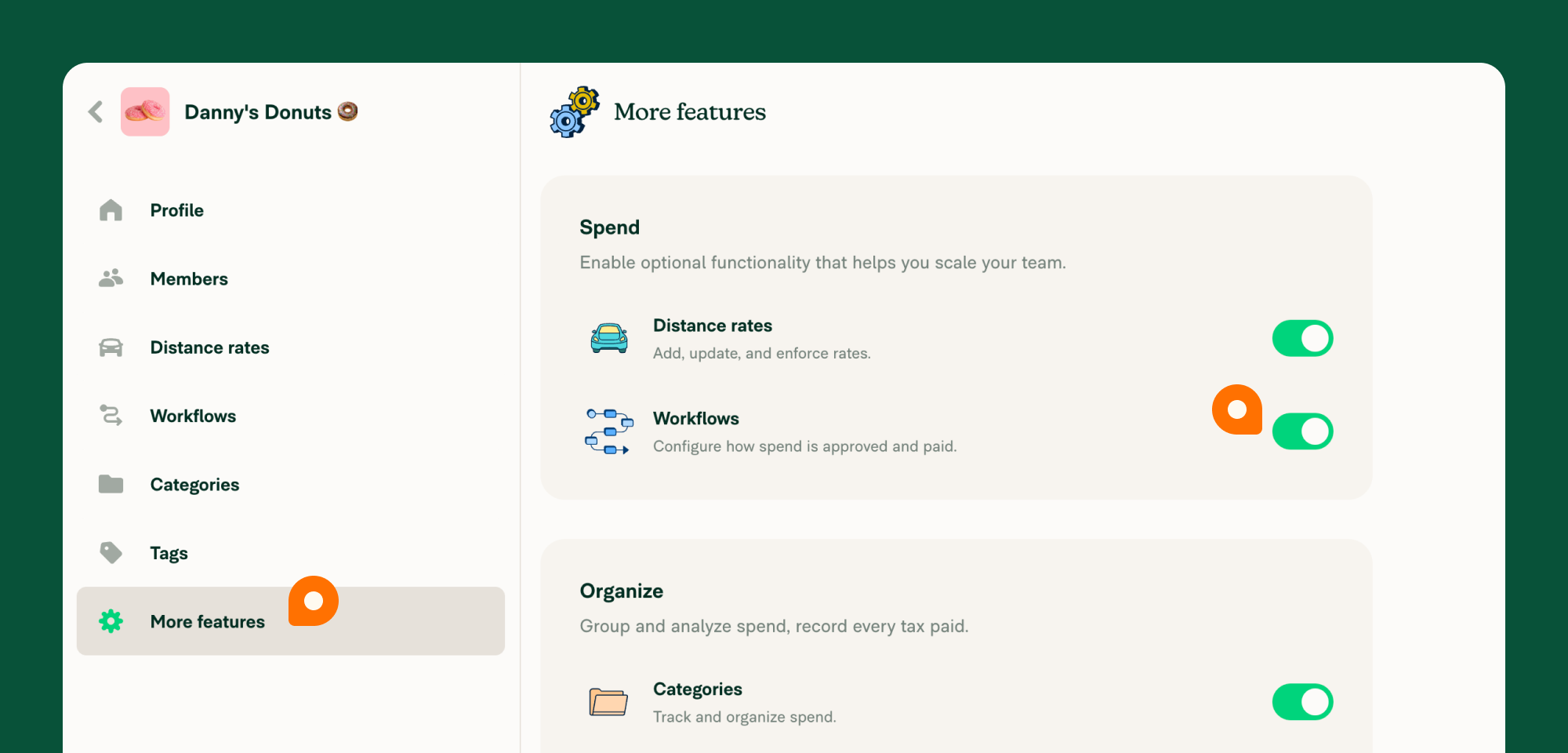

- Navigate to [Workspace Name] > More Features.

- Click Enable Workflows.

- A Workflows setting will appear in the left-hand menu.

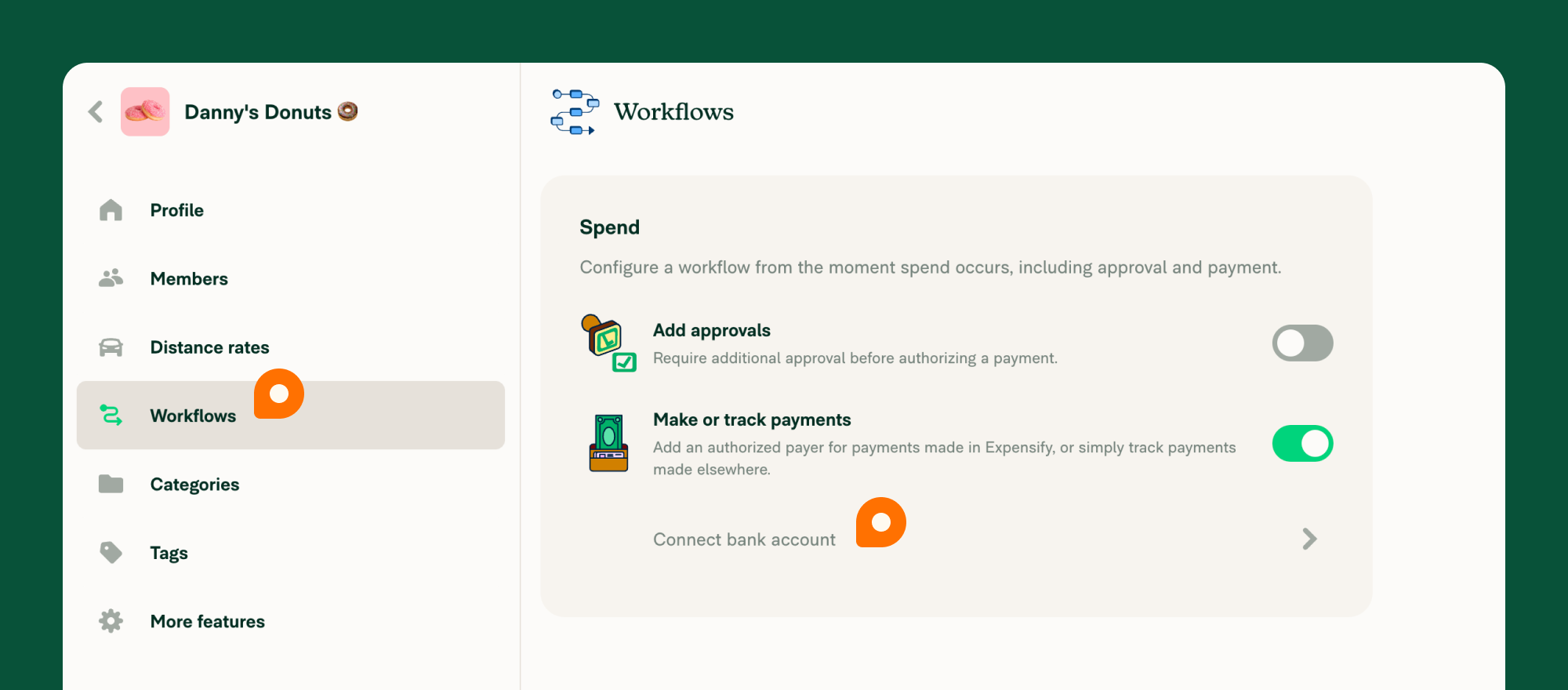

- Click Workflows and enable Make or Track Payments.

Step 2: Connect your business bank account

- Click Connect Bank Account.

- Select either Connect online with Plaid (preferred) or Connect manually.

- Enter your bank details.

Step 3: Verify your identity with a U.S.-issued photo ID

After entering your personal details, you’ll be prompted to complete identity verification:

- Upload a photo of the front and back of your ID (cannot be a photo of an existing image).

- Use your device to take a selfie and record a short video of yourself.

Your ID must be:

- Issued in the US.

- Current (expiration date must be in the future).

Step 4: Add company details for bank account verification

Add your company details, including:

- Company Address: Must be a physical US location (PO Boxes or mail drop addresses will be flagged for review and may delay verification).

- Tax Identification Number (TIN): Assigned by the IRS.

- Company Website: Required to access most Expensify payment features.

- Industry Classification Code: Find the list of codes here.

Step 5: Add Beneficial Owner details (if applicable)

- Check the appropriate box under Beneficial Owner:

- A Beneficial Owner is an individual who owns 25% or more of the business.

- If no individual owns 25% or more, leave both boxes unchecked.

- Accept the agreement terms and verify that all details are true and accurate.

Step 6: Wait for documentation review

In some cases, Concierge may request additional documents (e.g., business address verification or a bank letter). If this happens, Concierge will follow up directly.

Step 7: Watch for the test transaction message

Once your account is nearly ready, you’ll see the message: “Your bank account is almost set up!”

This means Expensify has sent three test transactions (usually arriving within 1–2 business days). You’ll need these to complete setup.

Step 8: Validate the test transactions

- Return to Settings > Workspaces > [Workspace Name] > Workflows > Payments.

- Click Enter test transactions.

- Input the three exact amounts and click Validate.

Once validated, your verified business bank account is fully connected and ready to use.

FAQ

What are the general requirements for adding a business bank account?

To add a business bank account for ACH reimbursements (US) or Expensify Cards:

- Enter a physical address for yourself, any Beneficial Owner (if applicable), and the business.

- US photo ID, address, and SSN are required for all individuals associated with the account.

Are there certain industries or businesses for which Expensify cannot process automatic, in-app payments?

Yes, Expensify cannot process direct payments for businesses in the following industries:

- Security Brokers & Dealers

- Dating & Escort Services

- Massage Parlors

- Casinos & Gambling/Betting Services

- Non-FI, Money Orders

- Wires, Money Orders

- Government-Owned Lotteries

- Government-Licensed Online Casinos (Online Gambling)

- Government-Licensed Horse/Dog Racing

- Crypto-currency businesses

- Internet gambling

- Marijuana-related businesses

- Firearm-related businesses (manufacturing and selling)

- NFT (non-fungible token) services

What is a Beneficial Owner?

A Beneficial Owner is an individual who owns 25% or more of the business. If no individual meets this threshold, you do not need to list a Beneficial Owner.

What if my business is owned by another company?

Please only check the Beneficial Owner box if an individual owns 25% or more of the business.

Why can’t I input my address or upload my ID?

All individuals associated with the account must have a US address, US photo ID, and a US SSN. If you do not meet these requirements, an admin who qualifies should add the bank account.

Why am I asked for documents when adding my bank account?

Expensify follows federal regulations (BSA / AML laws) and anti-fraud measures. If automatic verification fails, we may request manual verification (e.g., address verification, bank ownership letter, etc.). Contact Concierge for assistance.

I don’t see all three microtransactions I need to validate my bank account. What should I do?

Wait two business days. If still missing, contact your bank and ask them to whitelist our ACH IDs:

- 1270239450

- 4270239450

- 2270239450

Expensify’s ACH Originator Name: Expensify.

Once completed, contact Concierge to re-trigger the microtransactions.

Is my data safe?

Yes! Expensify uses bank-level security measures and is tested daily by McAfee. Learn more about our security policies here.