Unlimited Virtual Cards

Domain Admins can issue an unlimited number of virtual cards with either a fixed or monthly limit for specific purchases or recurring subscriptions (e.g., Marketing, Advertising, Travel, AWS, etc.).

Virtual cards are ideal for businesses that need control over spending as Domain Admins can set individual spending limits for each virtual card.

Use virtual cards if your company needs:

- One card per vendor or subscription

- Cards for one-time purchases with a fixed amount

- Cards for events or trips

- Cards with a low limit that renews monthly

Admins can name each card for easy tracking and organization. This makes categorizing expenses in the Expensify platform simple.

Set up Virtual Cards

After upgrading to the Expensify Card, domain admins can issue virtual cards to any employee with an email matching your company domain. Once assigned, the virtual card will appear under the card’s assigned name.

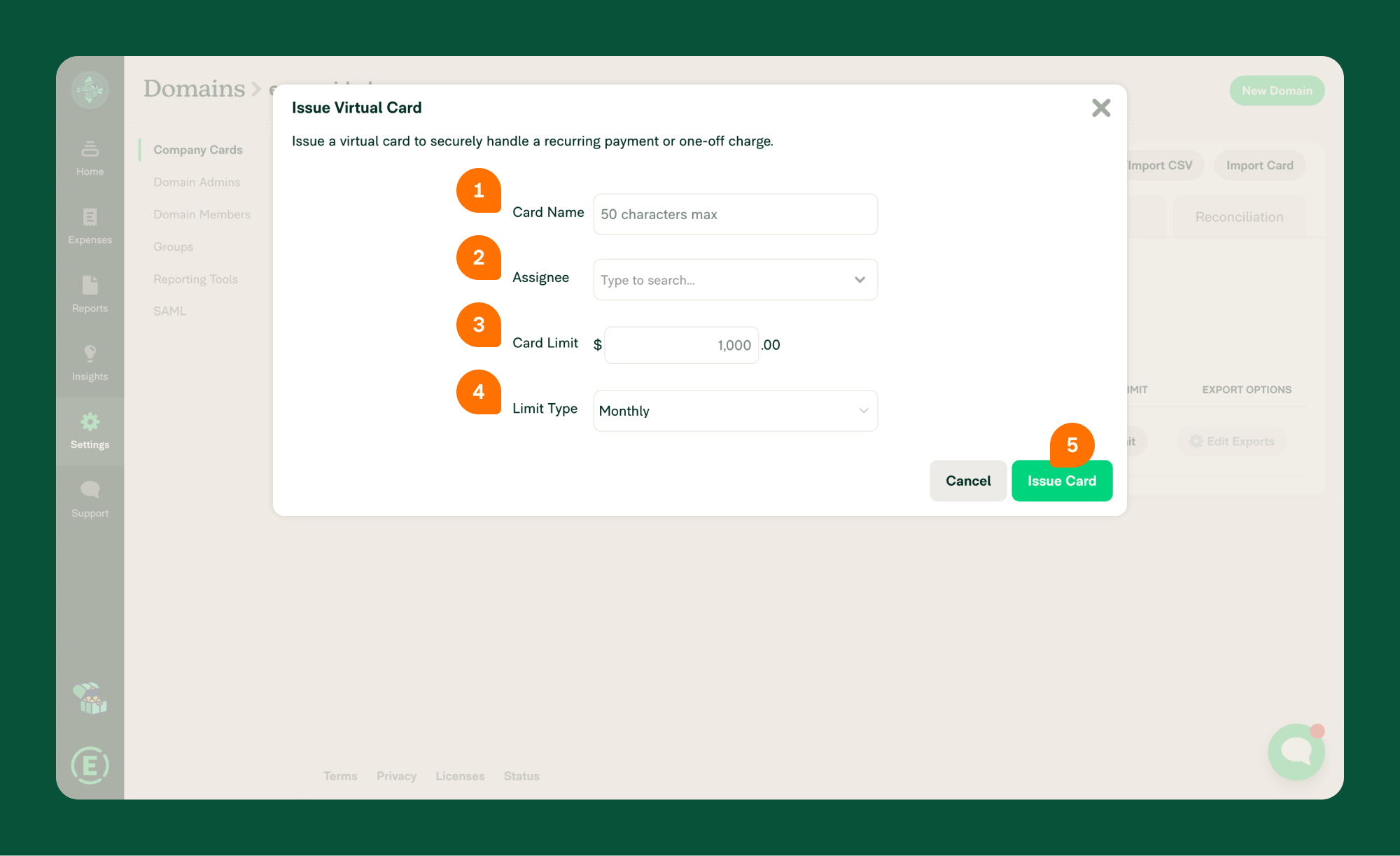

To assign a virtual card:

- Go to Settings > Domains > Company Cards.

- Click Issue Virtual Cards.

- Enter a card name (e.g., “Google Ads”).

- Select a domain member to assign the card to.

- Set a card limit.

- Choose Limit Type (Fixed or Monthly).

- Click Issue Card.

Edit Virtual Cards

Domain admins can edit the details of any virtual card on the Company Cards page.

To edit a virtual card:

- Click the Edit button next to the card.

- Update the details as needed.

- Click Edit Card to save changes.

Terminate a Virtual Card

Admins can terminate a virtual card by setting the limit to $0.

To terminate a virtual card:

- Click the Edit button next to the card.

- Set the limit to $0.

- Click Save.

- Refresh the page, and the card will be removed from the list.

FAQ

What’s the difference between a fixed limit and a monthly limit?

- Fixed-limit cards are ideal for one-time purchases or specific purchases with a set amount.

- Monthly-limit cards are best for recurring expenses like subscriptions or memberships.

Both limit types are independent of other cards, including any smart limit cards.

Where can employees see their virtual cards?

Employees can view their assigned virtual cards by going to Settings > Account > Wallet in their accounts.

Here, they can see:

- Remaining card limit

- Card type (e.g., fixed or monthly)

- The name of the card

To view card details, they’ll click Show Details.

Note: If the employee hasn’t enabled Two-Factor Authentication (2FA), they will be prompted to enable it before displaying card details. 2FA is required for disputing virtual card charges.

What should I do if there’s fraud on a virtual card?

If a virtual card is lost or compromised, or you suspect fraud, request a new card immediately. If the employee is unavailable, the domain admin can set the card limit to $0 to terminate it.

When a new card is requested, the old card is immediately deactivated. Always act quickly in the case of fraud to minimize financial impact.