Tax Exempt

If your organization is recognized as tax-exempt by the IRS or other local tax authorities, you can request tax-exempt status in Expensify to avoid tax charges on your monthly bill. Follow these steps to submit your request.

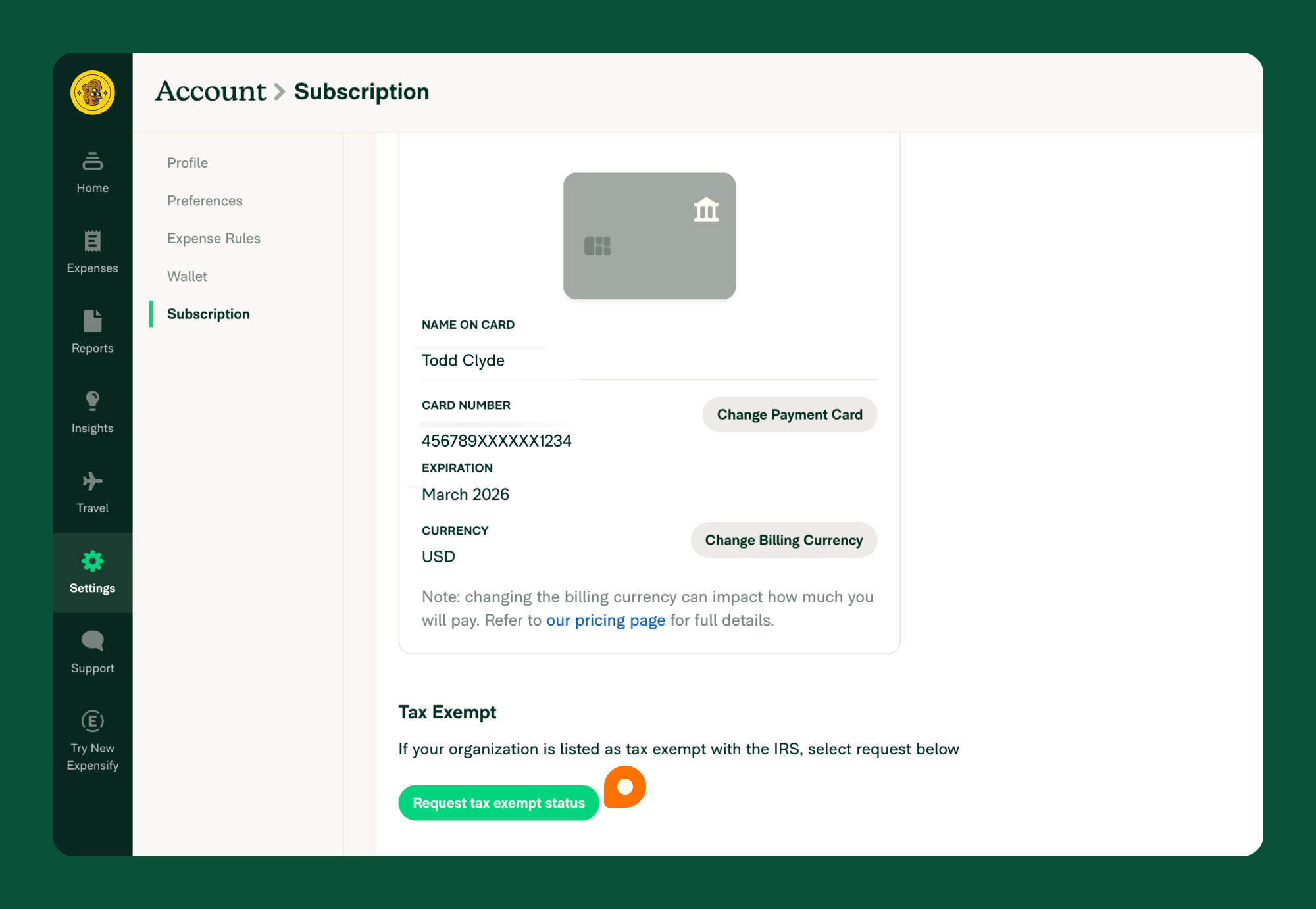

Request Tax-Exempt Status

- Go to Settings > Account > Subscription.

- Click Request Tax-Exempt Status.

- Concierge will reach out to you for documentation. Upload a PDF of your tax-exempt certification. Your document should include your VAT number (or RUT in Chile). Accepted documents include:

- 501(c) (for U.S. organizations)

- ST-119

- Foreign tax-exempt declaration

- Our team will review your submission and request any additional information if needed.

- Once verified, your account will be updated, and tax will no longer be applied to future billing.

If you need to remove your tax-exempt status, contact your Account Manager or Concierge to make that request.

FAQ

Will Expensify refund past tax charges?

Yes! If tax was incorrectly applied to your past bills, Expensify can issue a refund. Contact your Account Manager or Concierge to request a refund.